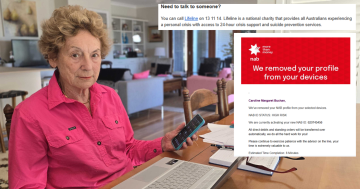

Bendigo Bank is now operating in Cooma. Photo: Gail Eastaway.

Bendigo and Adelaide Bank has marked its 25th anniversary of community banking with the migration of more than 12,000 Service One Mutual Limited members across to the Bendigo Bank network.

Cooma is one of the latest towns to be involved in the migration, joining Bombala which opened a branch earlier this year.

From 17 June 2023, Service One members now have access to nine branches powered by the full banking capability offered by Bendigo and Adelaide Bank Group.

Service One Mutual Limited has been serving members for more than 60 years and has a long-standing relationship with Bendigo Bank through its founding membership of the Alliance Bank group, a Bendigo and Adelaide Bank brand.

The move will make the new partnership among the largest Community Bank networks in Australia, with Service One Mutual Limited establishing a new subsidiary, Service One Financial Services Pty Limited, under which its branches in Deakin, Belconnen, Tuggeranong, Cooma, Tumut, Batemans Bay and Newcastle will operate.

Two ACT Community Bank branches in Calwell and Curtin will also join the new partnership on 3 July 2023.

Service One Mutual Limited CEO Matthew Smith, said, “The board and executive team believe that the decision to formally join the Bendigo Community Bank network is a great outcome for members. There is a natural synergy with the Bendigo Community Bank network in that we are both committed to investing in the communities we serve.

“Our local teams remain in place providing members with friendly, familiar faces and the support members have come to love. Our customers now also enjoy the convenience of a national network of more than 440 Community Bank and Bendigo Bank branches, phone support seven days a week, enhanced technology and a wider range of products and services.

“Bendigo Bank’s unique Community Bank model is celebrating 25 years of community owned and operated banking in Australia and it is wonderful to be able to join the network as one of the largest Community Bank companies in Australia in our 25th anniversary week,” Mr Smith said.

The internationally acclaimed Bendigo Community Bank model has grown from a concept designed to empower communities at risk of losing face-to-face banking services, to a network of more than 300 branches nationally with $20 billion in loans and $31.3 billion in deposits.

Founded in 1998 with branches in Rupanyup and Minyip, Victoria, the secret to its success can be traced back to the profit-with-a-purpose model which sees a majority of the profits generated by each independently owned and operated Community Bank directed back into the community.

Mr Smith said: “We would particularly like to congratulate Bendigo Bank and Community Banks Rupanyup and Minyip on their 25th anniversary and are delighted to join the network. The important steps they took made it possible for communities like ours and many others to take charge of our future, support economic growth and provide grants and sponsorships that underpin and strengthen the social fabric in regional areas.

“Collectively, the Community Bank model is on track to return a total of $300 million in profits in its anniversary year, since inception, which is just amazing. Community Bank funding often attracts co-investors such as local, state and federal governments which creates a multiplier effect on the capital raised, enabling projects that to date have a combined total of more than an estimated $1 billion.

“We look forward to building on these community strengthening initiatives in southeast NSW and you will now notice our distinctive branch network in fresh livery in towns from the Snowies to the sea, across the ACT and up to the Southern Highlands,” Mr Smith said.