NSW Valuer General Sally Dale reporting on the coastal NSW value of land as at 1 July 2023. Photo: NSW Government.

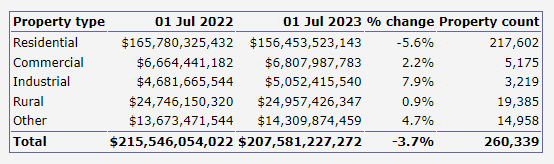

The value of land in the South Coast region showed a slight decrease (3.7 per cent) in the year between 1 July 2022 and 2023, from $215.5 to $207.5 billion.

NSW Valuer General Sally Dale recently published the numbers affecting the local government areas of Bega Valley, Eurobodalla, Kiama, Shellharbour, Shoalhaven, Wingecarribee, Wollondilly and Wollongong.

Valuations are based on the land alone and do not include any structures on it, but property sales are considered the most important factor in their calculations. Revenue NSW will use the new values to calculate land tax for owners subject to it over the 2024 period.

Total land value statistics for the South Coast region in the year between 1 July 2022 and 1 July 2023. Photo: NSW Government.

According to the report, driving this overall dip across the region was a moderate decrease in residential land value (5.6 per cent).

“The market had slowed due to reduced demand, interest rate rises and inflation. This trend was generally consistent across all coastal regions,” said Ms Dale.

Shoalhaven (-10.2 per cent) and Wollongong (-6.2 per cent) saw the largest declines in residential land values, which were attributed to continuing interest rate rises, inflation and construction costs that have impacted most market sectors.

However, demand remained steady due to the interest of owner occupiers and investors in coastal locations near Sydney.

Commercial land (2.2 per cent) in the region showed a slight increase in value, with Kiama (10.6 per cent) leading the charge and holding a relatively stable level of demand despite limited supply throughout the period.

Yet the tightly held nature of the region’s commercial market kept the values of Bega Valley (-0.5 per cent), Shellharbour (0.1 per cent) and Wollongong (0.8 per cent) in tow with recent years.

There was a moderate increase for industrial land (7.9 per cent), with growing population bases and a limited supply of suitably zoned land being held responsible for this. Increases were highest in Wollondilly (29.5 per cent), Kiama (23.1 per cent), and Eurobodalla (17.1 per cent).

Wollondilly’s significant valuation is due to its proximity to Sydney, with existing infrastructure in the Thirlmere, Picton and Maldon (heavy industrial) precincts.

As for rural land, values remained steady (0.9 per cent).

“This trend was broadly consistent across the region with most properties considered rural lifestyle, which generally follow the residential market,” said Ms Dale.

Again, the largest increases were seen in Wollondilly (5.7 per cent) and Kiama (4.5 per cent), due to purchasers transitioning from residential suburbs or other more densely populated areas to lifestyle properties. Shoalhaven (-3.3 per cent) and Bega (-3.1 per cent) saw a slight decrease, which is partially a result of the weakening residential market.

Revenue NSW will send their land tax assessments to registered clients from this month, but more information can be found on the matter within their website. The NSW Government Valuer General’s website also lists the latest land values for all NSW properties, along with information on trends, medians, and typical land values for each local government area.