Michael McCormack says the government legislation to protect scam victims is “rushed”. Photo: Supplied.

Should banks compensate their account holders if they lose money to financial scams?

According to regulator Scamwatch, Australians lost more than $318 million to scams in 2024.

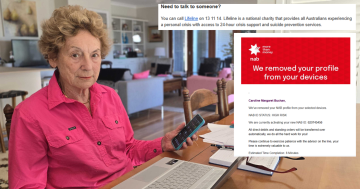

This includes 80-year-old Wagga woman Caroline Buchan, who as Region reported, lost $34,000 to a person allegedly pretending to be a National Australia Bank (NAB) fraud squad official.

NAB was unable to recover or refund her money, so suggested Ms Buchan “call Lifeline”, prompting calls for the government to do more to hold financial institutions to account.

The Federal Government has already put legislation forward to require banks to report and combat fraudulent activity. However, its proposed scheme does not require them to provide mandatory compensation for scam victims. Rather, those scammed must go through a lengthy process to prove they deserve redress.

Riverina MP Michael McCormack says making banks compensate all victims would have negative consequences.

“The challenge with making banks responsible for every single scam debt is that it would likely lead to the incidence of scams going through the roof with scammers knowing banks would have to stump up any cost incurred to victims and customers would also become less vigilant knowing the banks would be liable to provide compensation,” he said.

Plasterer and Australian Citizens Party candidate for the same seat Richard Foley described this as “nonsense”.

“The British have a law in place that forces banks to compensate scam victims. That hasn’t sent banks bankrupt,” he said.

“Right now, victims — especially elderly Australians — are being left to fend for themselves while the banks wash their hands of any responsibility. This woman in Wagga who lost $34,000 to scammers must be compensated immediately, with damages paid for the distress caused. Instead of giving victims the runaround, the banks must be held accountable for their failure to protect their customers.

“What is it about the major parties not wanting to hold banks to account?”

Caroline Buchan fell victim to a highly elaborate alleged scam. Photo: Shri Gayathirie Rajen.

Ms Buchan also disagrees with Mr McCormack, saying a mandatory compensation scheme would put the heat on banks to lift their game.

“[It would push banks] to start an education program which would reduce scammers’ success and therefore reduce bank payment commitments,” she said.

Mr McCormack said stronger action must be taken to help prevent the incidence of scams and that he was supportive of the concept of a scams prevention framework, though he described the government legislation as “rushed” and “stacked against consumers”.

Researcher Dale Webster, who has long campaigned against the big banks’ treatment of rural Australians, says financial institutions have pushed elderly customers into vulnerable positions by forcing them online when they’d prefer face-to-face service.

“Bank staff performance targets to continually badger customers until they agree to put the app on their phone,” she said.

“Once the app is on their phone, they’re vulnerable whether they know how to use it or not.

“There is a significant access problem, especially with the elderly … when they do have a problem, they can’t call the bank … they are put onto call centres and they have to navigate putting numbers into the phone to speak to someone.”

Meanwhile, NAB continues to refuse to answer questions about their handling of Ms Buchan’s case. The 80-year-old says she was scammed by a man pretending to be a NAB official who somehow knew her customer number.

Region asked NAB whether it investigated if failings or leaks in its own security department may have contributed to Ms Buchan losing her money. The bank did not respond. It also said it supplied third-party resources to victims, such as Lifeline.

The Federal Government’s legislation to strengthen protections for scam victims is expected to be voted on by the Senate soon.

Independent ACT Senator David Pocock shared Region‘s article on Ms Buchan on social media to illustrate how the government’s proposed law isn’t good enough.

“The government’s scams legislation goes against advice from experts and consumer groups who want a reimbursement model that ensures people get refunded if they’re not at fault,” he said.

“Instead, industry has pushed for a complicated model that will make it hard for people to get [their money] back.

“I’ll be moving amendments to protect Australians.”

Original Article published by Shri Gayathirie Rajen on Region Riverina.