The Junee CBA branch was scheduled to close in March. Photo: Supplied.

Australia’s biggest lender, the Commonwealth Bank, has announced it will extend its promise not to close any regional branches for at least three more years.

Following a grassroots backlash in February when branches, including Junee’s last bricks-and-mortar bank, faced closure, the CBA had agreed to a pause for 2023 while a Senate committee conducts an inquiry into the impact on regional communities.

Westpac followed suit and agreed to halt the planned closure of eight regional branches until the report is released in December 2023.

A protest outside the Commonwealth Bank in Junee in February. Photo: Struan Timms Photography.

Last week, NAB announced it will close branches in Temora and Gundagai, along with plans for a $2.9 million investment in a banking hub in Wagga.

Temora Mayor Rick Firman labelled the move a “kick in the belly” for the community, while Cootamundra-Gundagai Mayor Charlie Sheahan said it was challenging.

“There’s no real commitment to customer service at all. It’s profit-driven, and they are ignoring our communities,” he said.

CBA closed 68 branches in the last financial year, but will now maintain all existing regional branches until at least the end of 2026.

“We recognise the way people are banking is changing, with more customers adopting the benefits offered by digital and phone-based services,” said Retail Banking Services group executive Angus Sullivan.

“Through this time of change, we want to support customers in regional areas who prefer banking in branches and so we will maintain our existing face-to-face services in these communities.”

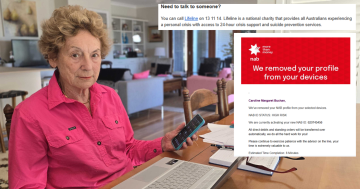

National Australia Bank will close its branches in Gundagai and Temora. Photo: Supplied.

Federal Member for Riverina Michael McCormack said the CBA was doing its duty as a responsible corporate citizen.

“I appreciate that it is not a guarantee of banks staying open, but it is a commitment to the regions,” Mr McCormack said, before taking a veiled jab at the NAB.

“I encourage all banks with a regional footprint to follow this lead to ensure our smaller communities are reassured in what are challenging times for all Australians.

“I look forward to the Senate inquiry into bank closures in regional Australia delivering its findings later this year.”

Mr Sullivan said the CBA would continue to evolve its digital platforms and develop “multi-channel branches” that provided face-to-face services the first part of the day, before the office closed to customers and branch staff transitioned to assist online support and call centres.

“Multi-channel branches allow us to maintain a strong physical presence across regional Australia, safeguard and upskill regional employment, and help CBA meet increasing customer demand for phone and digital banking services across the country.”

Further details on the Senate inquiry into regional bank closures can be found here. The committee is due to hand down its report and recommendations on 1 December, 2023.

Original Article published by Chris Roe on Region Riverina.